January 2021 Market Comment:

What will it bring for the Property Market?

No doubt this year more than every will be difficult to predict in the short term with the ongoing matter of the pandemic, any fall out from Brexit and of course the usual issues of affordability, supply and demand will all again this year and in their own locality, play a part in what happens.

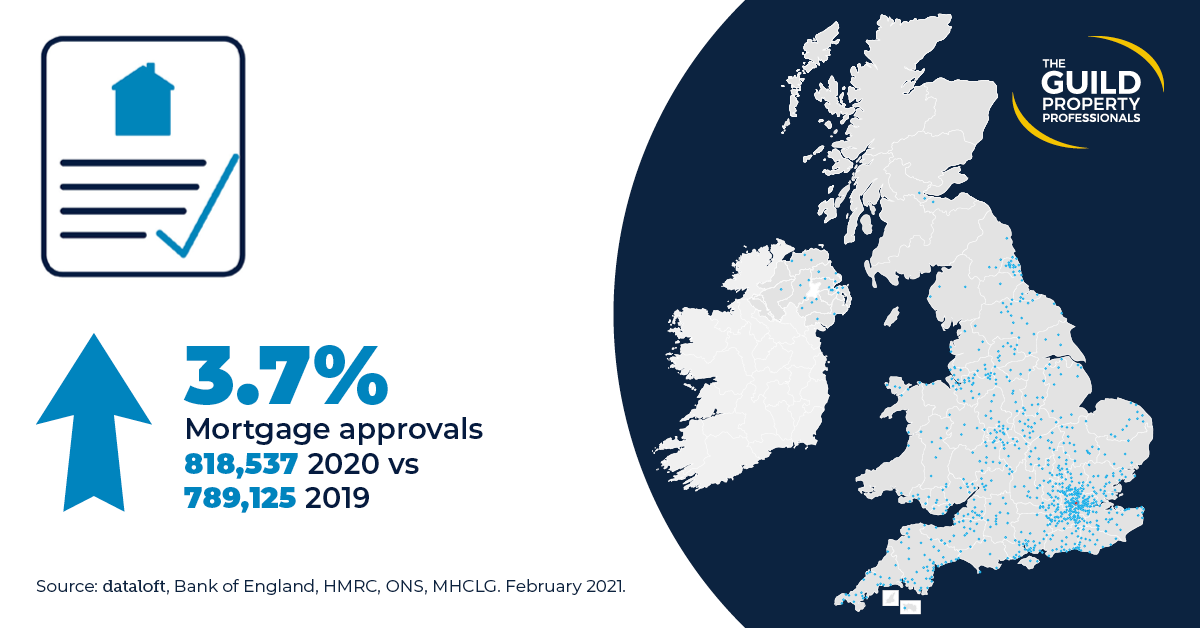

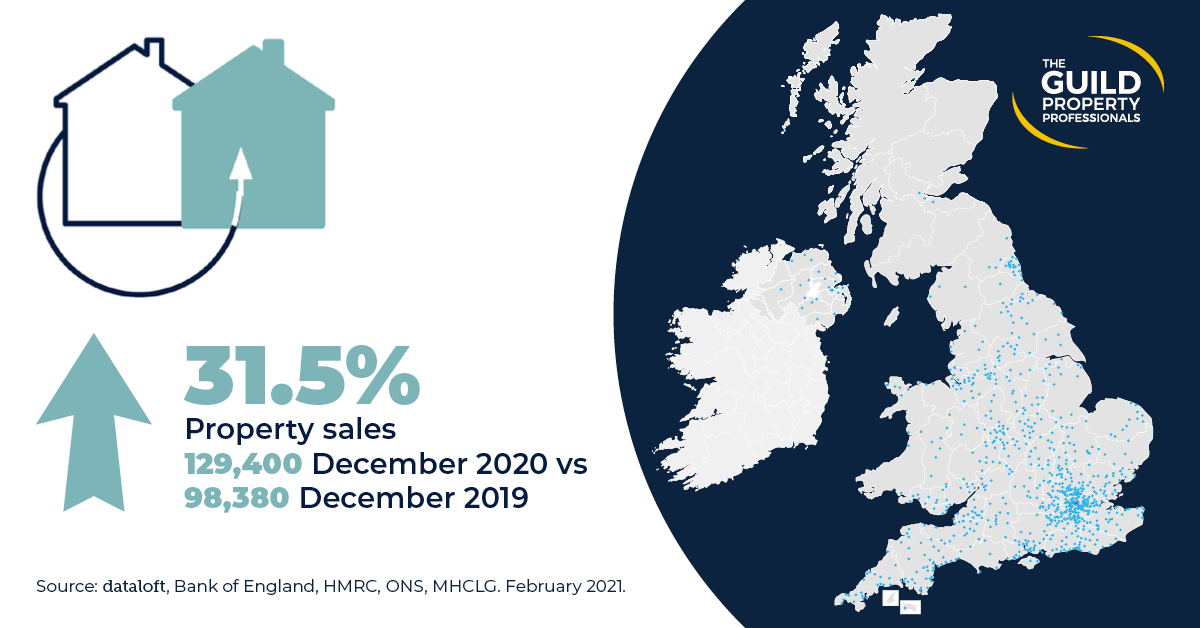

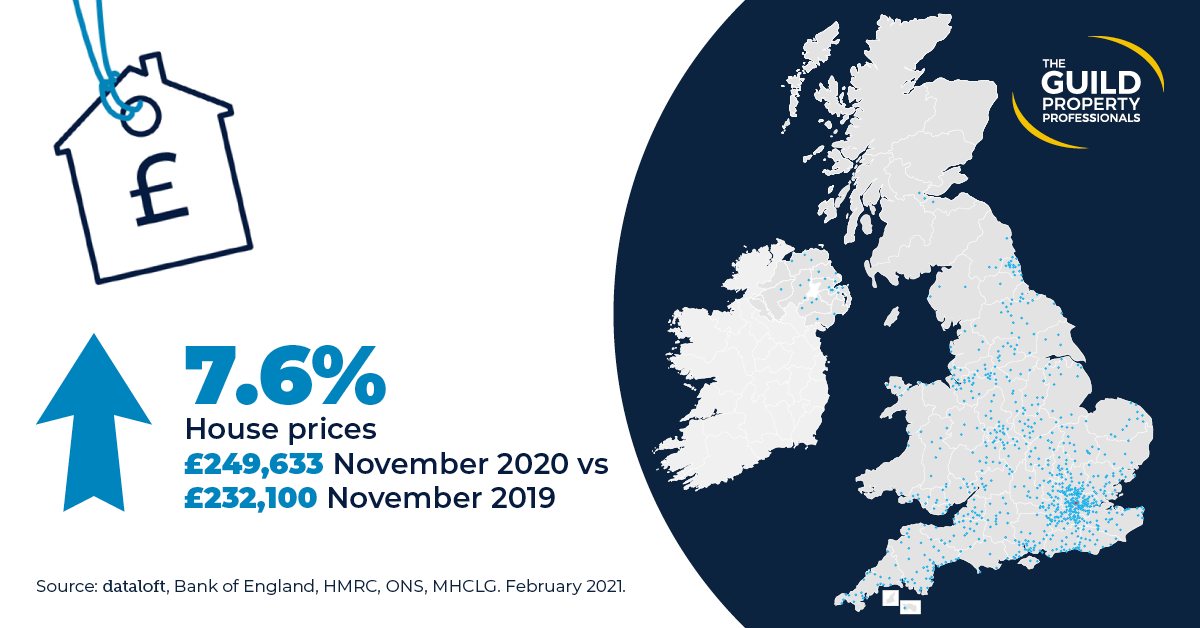

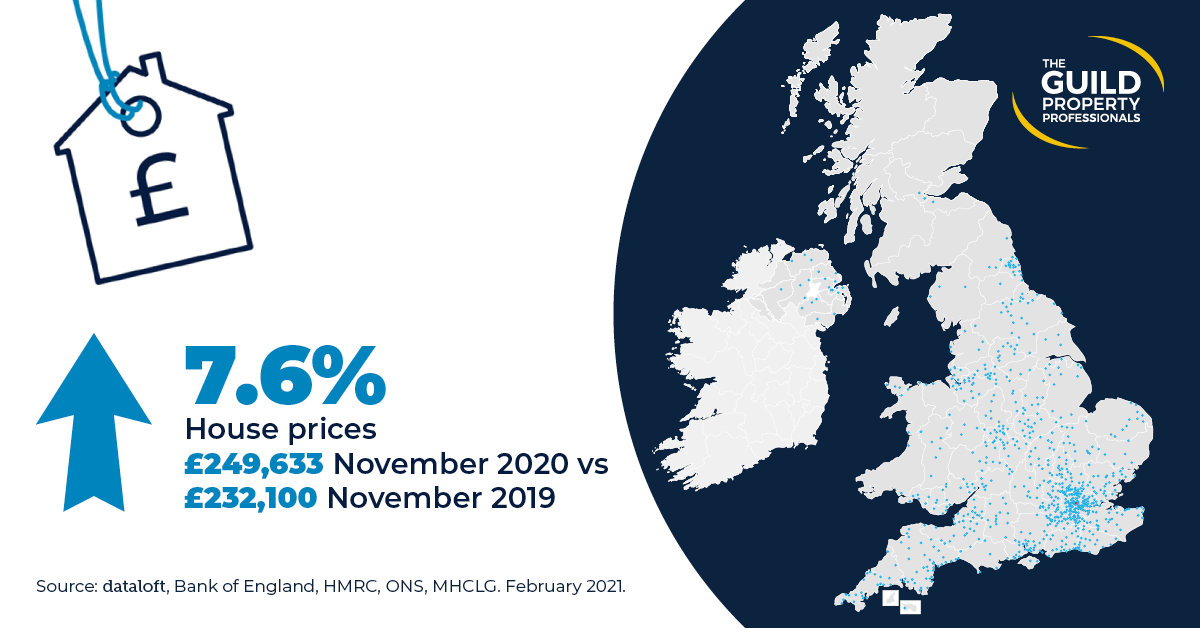

According to the Nationwide Building Society, despite the pandemic, the average UK house price ended the year 7.3% up on the previous year with our area statistics displaying around 5.4% price growth. Remarkably there is still a lot of heat in the market - with website activity on Boxing Day being 70.5% up on last year! (Source: Property Portals). You might expect that tougher Covid-related restrictions and our formal departure from Europe at the end of last month would have seriously damaged the property market, yet the opposite seems to be true. It may be that this surge in activity towards the end of the year just catching up for the sales that did not, or could not happen in the first lockdown back in the spring

The LTT concession in place is currently due to end on 31st March 2021. Whilst campaigners are calling for this to be extended or at least have a softer ending rather than the proposed “cliff edge” stop date (over 72,000 have now apparently signed a petition) the impact here in Wales is expected to be less than across the border. In Wales the concession was on main residence property only, up to £250,000 while across the border buyers on property up to £500,000 have been benefiting from the concession. The pressure is now on for those to purchase before the deadline.

Once this tinkering with the market has ended there may be a small pause in activity however we do believe that all else being equal the traditional spring market will continue as for whatever reason people we will still need to find a home and others will have to move.

What is likely to have the greatest impact in the coming months in the property market will be employment and any redundancies which may appear as furlough schemes and other business support packages are finished. For the wider economy, it may be better for the furlough scheme to be extended rather than LTT (stamp duty). This in our view would benefit more people and the whole economy.

Whenever there is change, the opportunity for prosperity is not far behind. In 2021, we’ll have immense change-related opportunities, not just following Covid, but also related to Brexit. While builders, homeware and garden-suppliers are busy providing for people resigned to spending more time at home, many manufacturers are turning their attentions to making products in the UK that had previously been imported from Europe. Brexit will no doubt also continue to cause instability in the stock market for some time to come. When this has happened in the past, investors have flocked to bricks and mortar as a proven and reliable safe haven for their money.

People will always need a home and this usually bodes well for the lettings sector. Demand has been strong in the last quarter of 2020 with average rents in our area increasing to over £700 for the first time. One has to question if this is sustainable and if the sales market slows down, more property may enter the lettings market which may then affect yields and rental levels.

Macro-economists point out that both Brexit and the Pandemic will turn out to be just minor blips on their charts in the future, with some predicting a return to pre-pandemic levels within 18 months. The fundamentals of the economy remain very sound and it is this, more than any other influence, that supports the property market. We are after all the fifth largest economy in the world! That Stamp duty Concession was helpful, but it would not have prompted people to move unless they actually had a strong desire to do so based on market confidence and their personal lifestyle preferences.

In the interim period, virtual valuations and viewings backed up by knowledgable teams of property professionals who know the local market place may well continue to be a popular safe choice for people who want or need to move quicker.

Most pundits are predicting modest growth almost immediately. So if you are planning to sell and then buy a higher value property than your current home, we suggest you act quickly, when you can, in a safe manner and put yourself in a strong position as both seller and buyer. There are more dynamics in play now than ever before and it can be confusing. So for up-to-the minute property buying, selling or investment opinion, please feel free to call us for some straight-talking good advice from the experts to help get you moving – enjoyably!

Please don’t hesitate to contact your local office listed below for a free “virtual” or “physical” overview, with a smile and no obligation, no paperwork, no fuss in a safe manner.

From the team here at Williams & Goodwin may we extend our best wishes for a safe, healthy and Happy New Year!

#Llangefni 01248751000

#Bangor 01248355333

#Holyhead 01407760500

#Caernarfon 01286677775

#Lettings 01248724040

#Auctions 01248753939

©Copyright 2021 Williams & Goodwin The Property People Ltd.